Scammers are actively exploiting the name TaxRise in a deceptive email scam designed to steal your personal information. The fraudulent message claims to be from TaxRise or the IRS and urges recipients to “review and sign” a tax document via a suspicious link. This alarming tactic preys on taxpayers who may be expecting legitimate correspondence about their 2024 tax return, creating a false sense of urgency and trust.

The email often appears as if sent from a supposedly credible source, using familiar services like DocuSign and mentioning secure storage platforms like SmartVault. However, the included “REVIEW DOCUMENTS” button is a trap that directs victims to a phishing website crafted to capture login credentials and sensitive data. This kind of scammer behavior relies on mimicking official tax communication without any real connection to the IRS or TaxRise.

Recipients should be highly skeptical of unsolicited emails requesting immediate action on tax documents, especially those asking for login details through unusual links. Genuine tax-related requests come through official channels and never demand passwords via email links. If you receive such a message, do not click the link, don’t provide any information, and verify your tax return status directly through trusted government or company websites.

Remember: staying informed and cautious can protect you from falling victim to fraudulent schemes like the TaxRise phishing scam. Always consult trusted sources or a tax professional if you have any doubts about communications regarding your taxes.

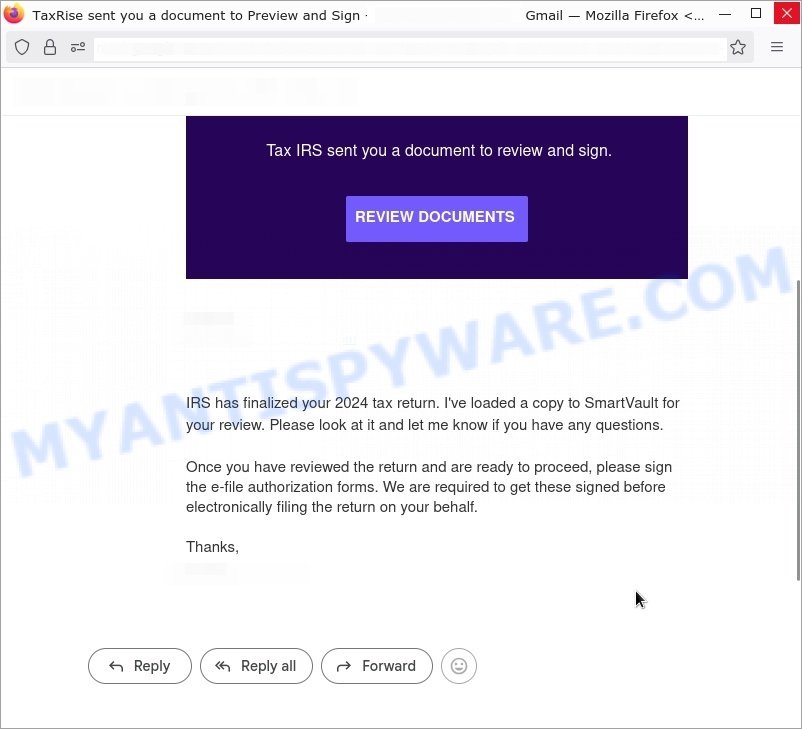

A typical “TaxRise sent you a document to Preview” scam email reads as follows:

Subject: TaxRise sent you a document to Preview and Sign

Sender: Tax Return via DocuSign tarun@apropostechnologies[.]comDocuSign

Tax IRS sent you a document to review and sign.

REVIEW DOCUMENTSIRS has finalized your 2024 tax return. I’ve loaded a copy to SmartVault for your review. Please look at it and let me know if you have any questions.

Once you have reviewed the return and are ready to proceed, please sign the e-file authorization forms. We are required to get these signed before electronically filing the return on your behalf.

Thanks

Summary Table

| Name | TaxRise Fake DocuSign Email Scam |

| Type | Email Phishing Scam |

| Method | Fake DocuSign email with link to phishing website |

| Sender | Tax Return via DocuSign tarun@apropostechnologies[.]com |

| Content | Claim about IRS finalized 2024 tax return, request to review and sign e-file authorization forms |

| Link | “REVIEW DOCUMENTS” leads to phishing site asking for login and password |

🚨 Is the “TaxRise Document Email” a Scam?

The email claiming that TaxRise sent you a document to preview and sign is a phishing scam designed to trick recipients into revealing their login credentials. This scam uses the guise of an official IRS or tax service communication to create a false sense of urgency and legitimacy.

Key Red Flags:

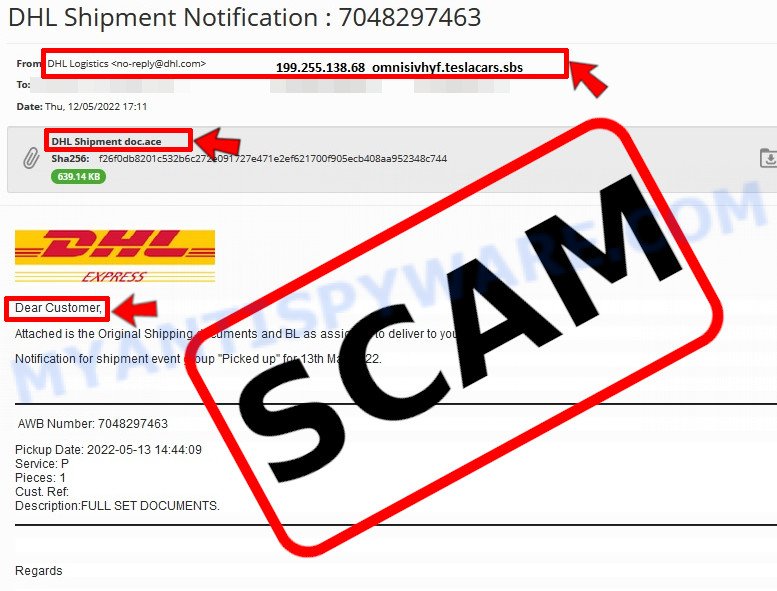

- 🌐 Suspicious Sender Address: The sender’s email (tarun@apropostechnologies[.]com) is unrelated to official IRS or TaxRise domains, signaling it’s not from a trusted source.

- ⭐ Fake DocuSign Notification: The email pretends to be from DocuSign but links to a phishing site instead of the genuine DocuSign platform.

- 🔒 Misleading Link: The “REVIEW DOCUMENTS” button directs you to a fraudulent website asking for login credentials, commonly used to steal personal or financial information.

- ⚠️ Urgent Language to Pressure Action: The message pressures you to act quickly under the pretext of finalizing your 2024 tax return, a common tactic to lower your guard.

- 📉 Poor Email Formatting and Generic Greetings: The email lacks personalization and has inconsistent formatting, which are typical signs of phishing attempts.

- 👤 Unverified Claims and No Official IRS Links: The email references “SmartVault” and “e-file authorization forms” but offers no verifiable links or contact information from official tax authorities.

In summary, this “TaxRise sent you a document” email is a phishing scam trying to capture your sensitive login information. Never click on suspicious links or provide personal details without verifying the sender independently. If you receive such an email, delete it and contact your tax preparer or the official IRS website directly for confirmation. Always stay vigilant against email scams pretending to be from tax or financial institutions.

📧 What to Do When You Receive the “TaxRise sent you a document to Preview” Scam Email

We advise everyone who receives this email to follow the simple steps below to protect yourself from potential scams:

- ❌ Do not believe this email.

- 🔒 NEVER share your personal information and login credentials.

- 📎 Do not open unverified email attachments.

- 🚫 If there’s a link in the scam email, do not click it.

- 🔍 Do not enter your login credentials before examining the URL.

- 📣 Report the scam email to the FTC at www.ftc.gov.

If you accidentally click a phishing link or button in the “TaxRise sent you a document to Preview” Email, suspect that your computer is infected with malware, or simply want to scan your computer for threats, use one of the free malware removal tools. Additionally, consider taking the following steps:

- 🔑 Change your passwords: Update passwords for your email, banking, and other important accounts.

- 🛡️ Enable two-factor authentication (2FA): Add an extra layer of security to your accounts.

- 📞 Contact your financial institutions: Inform them of any suspicious activity.

- 🔄 Monitor your accounts: Keep an eye on your bank statements and credit reports for any unusual activity.

🔍 How to Spot a Phishing Email

Phishing emails often share common characteristics; they are designed to trick victims into clicking on a phishing link or opening a malicious attachment. By recognizing these signs, you can detect phishing emails and prevent identity theft:

💡 Here Are Some Ways to Recognize a Phishing Email

- ✉️ Inconsistencies in Email Addresses: The most obvious way to spot a scam email is by finding inconsistencies in email addresses and domain names. If the email claims to be from a reputable company, like Amazon or PayPal, but is sent from a public email domain such as “gmail.com”, it’s probably a scam.

- 🔠 Misspelled Domain Names: Look carefully for any subtle misspellings in the domain name, such as “arnazon.com” where the “m” is replaced by “rn,” or “paypa1.com,” where the “l” is replaced by “1.” These are common tricks used by scammers.

- 👋 Generic Greetings: If the email starts with a generic “Dear Customer”, “Dear Sir”, or “Dear Madam”, it may not be from your actual shopping site or bank.

- 🔗 Suspicious Links: If you suspect an email may be a scam, do not click on any links. Instead, hover over the link without clicking to see the actual URL in a small popup. This works for both image links and text links.

- 📎 Unexpected Attachments: Email attachments should always be verified before opening. Scan any attachments for viruses, especially if they have unfamiliar extensions or are commonly associated with malware (e.g., .zip, .exe, .scr).

- ⏰ Sense of Urgency: Creating a false sense of urgency is a common tactic in phishing emails. Be wary of emails that claim you must act immediately by calling, opening an attachment, or clicking a link.

- 📝 Spelling and Grammar Errors: Many phishing emails contain spelling mistakes or grammatical errors. Professional companies usually proofread their communications carefully.

- 🔒 Requests for Sensitive Information: Legitimate organizations typically do not ask for sensitive information (like passwords or Social Security numbers) via email.

Conclusion

The TaxRise document email is a phishing scam designed to steal your personal information by masquerading as an official IRS or tax service communication. Fraudsters use fake sender addresses, urgent language, and fake document links labeled “REVIEW DOCUMENTS” to trick recipients into clicking on malicious phishing websites that request login credentials and sensitive data.

Instead of receiving legitimate tax documents, victims are directed to fraudulent sites posing as trusted services like DocuSign or SmartVault, where their information can be harvested for identity theft or financial fraud. The email falsely claims you have tax returns ready for review and signature, attempting to create a sense of urgency to prompt immediate action without proper verification.

Bottom Line: Do not click any links or provide any personal login information from unsolicited tax-related emails, especially from unknown senders like “tarun@apropostechnologies[.]com”. Always verify tax documents directly through official IRS channels or your trusted tax professional. Stay vigilant and skeptical of emails requesting sensitive data, particularly those urging immediate review or signature. If an offer or request seems suspicious or unexpected, it is likely a scam.